Save an average of 30% with FSA/HSA

RingConn has partnered with Flex to allow you to use your Health Savings Account (HSA) or Flexible Spending Account (FSA). This means you can now use your HSA or FSA debit card to buy RingConn with pre-tax dollars, resulting in net savings of 30-40%.

Shop NowHSA/FSA Payments Simplified with Flex

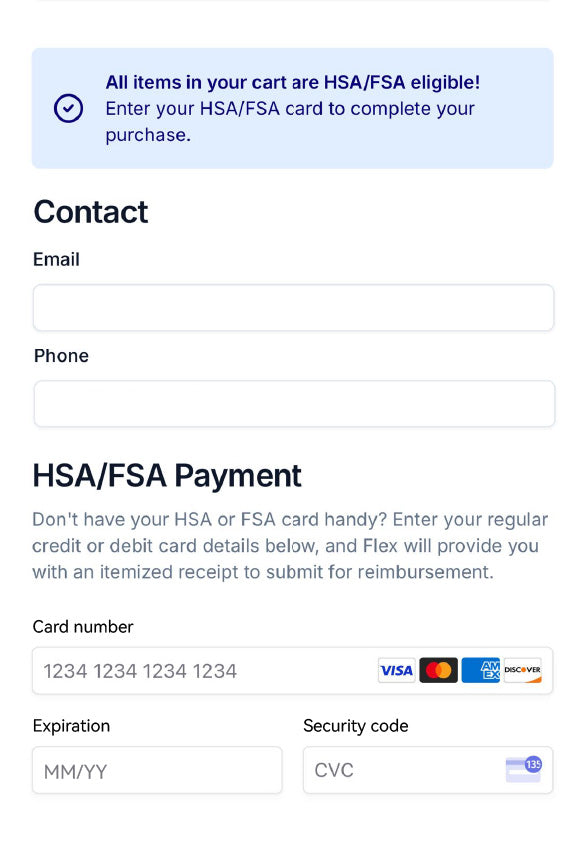

To use your HSA or FSA debit card, add products to your cart as usual. At checkout, select Flex | Pay with HSA/FSA as your payment option, enter your HSA or FSA debit card, complete your checkout as usual. If you don’t have your HSA or FSA card handy, you can enter credit card information and Flex will email you an itemized receipt to submit for reimbursement.

Add products to your cart

Select Flex at checkout

Enter your HSA/FSA card

FAQ

What is an FSA or HSA and what are the benefits?

An FSA (Flexible Spending Account) and an HSA (Health Savings Account) are tax-advantaged accounts for medical expenses but differ in key aspects. FSAs, employer-sponsored, allow employees to use pre-tax dollars for medical expenses such as prescriptions and copays, but typically feature a "use-it-or-lose-it" policy where funds must be used within the plan year. HSAs are available to those with a high-deductible health plan and offer more flexibility, allowing funds to roll over annually. For more information, see Flex’s Comprehensive Guide to HSA/FSAs

How does using my HSA/FSA account save me money?

HSA/FSA accounts were created so individuals could use pre-tax money to pay for expenses used to treat, mitigate, or prevent a diagnosed medical condition. Because HSA/FSAs use pre-tax money, you’re getting more purchasing power for your dollars. Rather than pay taxes on income and then spend it on health items, qualified customers can use pre-tax funds to invest in their health.An individual can contribute up to $3,850 pretax to their HSA per year, or $7,750 for a family (plus an additional $1,000 if you are at least 55 years old Individuals can contribute up to $3,050 pretax to their FSA per year (with an additional $500 in employer contributions allowed). Almost every qualified individual will save between $1,000 and $2,000, depending on their state and tax rate.

How can I spend my FSA or HSA funds at RingConn?

Select “Flex | Pay with HSA/FSA'' at checkout. Input your card details and checkout as usual.

I’m not seeing HSA or FSA options show up at checkout. Why not?

In this case, none of the items in your cart may be HSA or FSA eligible. Reach out to cs@ringconn.com if you think there is an error.

Why was my HSA or FSA card rejected?

Like any credit or debit card, HSA/FSAs can be declined if any of the data from the card is incorrect (number, expiration date, zip code etc). Flex will alert you in checkout if any of these fields is missing or incorrect so you can update them.The most common reason for rejection of the card is insufficient funds. Reach out to your HSA or FSA provider to verify the amount of money in your account before attempting to complete your purchase again.

I don’t have an HSA or FSA card. Can I still use my HSA/FSA funds?

Yes, you can still be reimbursed for the expense.Select “Flex | Pay with HSA/FSA” at checkout. Instead of entering your HSA or FSA card, input your regular credit card.Flex will email you an itemized receipt following your purchase. Submit the itemized receipt to your HSA or FSA provider for reimbursement.

Who is Flex and what is their relationship with RingConn?

Flex has partnered with RingConn to enable consumers to use their HSA/FSA funds. You can think of Flex as an alternative to payment method, similar to Affirm, Klarna etc.

I still have more questions on HSA/FSA. Who should I reach out to?

If you have more questions on HSA/FSA, please don’t hesitate to reach out to our customer service team at cs@ringconn.com. We’re here to provide the support and information you need to make the most of your benefits!